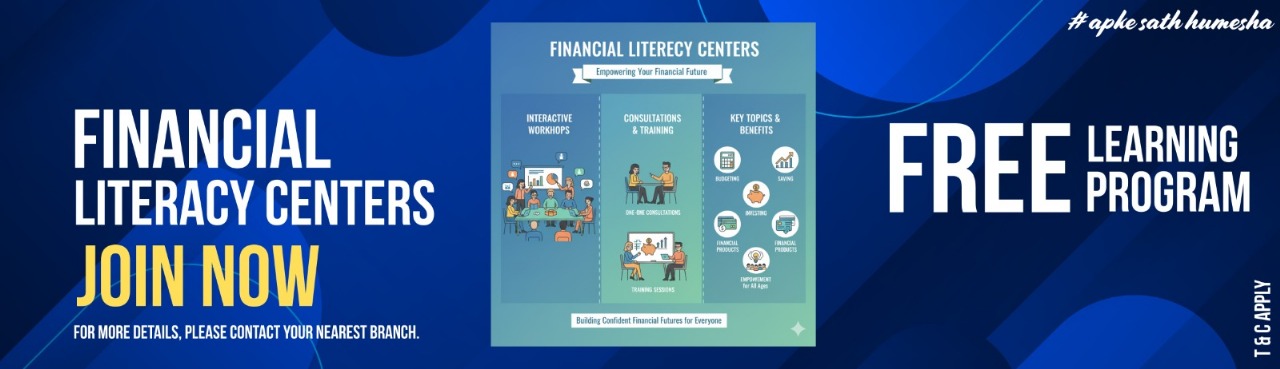

Financial Literacy Centers

Our Financial Literacy Centersare dedicated to empowering individuals and communities with the knowledge and skills needed to make informed financial decisions. Through a variety of interactive workshops, training sessions, and one-on-one consultations, these centers offer practical education on topics like budgeting, saving, investing, managing debt, and understanding financial products.

Open to people of all ages and backgrounds, our Financial Literacy Centers aim to bridge the gap between financial concepts and everyday practices. By demystifying the complexities of personal finance, we help you develop the confidence to manage your money effectively, plan for the future, and achieve financial stability.

Whether you're a student, a working professional, or a retiree, our centers provide tailored resources and support to help you take control of your financial journey. Join us at a Financial Literacy Center near you and start building a secure financial future today.

Features

-

Interest on deposit.

- Accidental insurance cover of Rs. 1 lac for Rupay Card. 2 Lakhs if Rupay debit card is issued after 28-8-2018.

- No minimum balance required.

- The scheme provide life cover of Rs. 30,000/- for accounts opened between 15.08.2014 to 31.01.2015.

- Easy Transfer of money across India.

- Beneficiaries of Government Schemes will get Direct Benefit Transfer in these accounts.

- After satisfactory operation of the account for 6 months, an overdraft facility up to Rs.10000/- will be permitted.

- Access to Pension, insurance products.